The preceding post began with a little-noticed quotation from Hillary Clinton’s acceptance speech at the Democratic convention: “I believe that our economy isn’t working the way it should because our democracy isn’t working the way it should.” We saw in that post that looking at this relationship the other way around is more useful: there are powerful economic forces that determine political outcomes and the success or failure of politics in democracy.

Despite the natural and virtually mandatory political stance of the Democratic Party that Barack Obama’s economic legacy is positive, the Democratic nominee is now charged with replacing Barack Obama, and extending the populism he has promoted and his economic legacy. Forced to concede that “our economy isn’t working the way it should,” she must now veer farther left than has been her custom, endorsing the most progressive DNC platform in decades.

The socioeconomic battle lines for the upcoming contest between Hillary Clinton and Donald Trump, and for upcoming Congressional and state gubernatorial contests, are drawn: Democrats will argue that Obama did what he could, but it wasn’t enough because of GOP obstructionism. The frightening thing about this election season is that, although this is largely true, Hillary Clinton must overcome unpopularity among progressives as well as the onslaught from the traditional Republican playbook (lower taxes and less government) to win this election. The terrifying truth, building on what we have learned about how the economy really works, is that an unrestrained Trump presidency would be a horrific economic disaster, with extremely serious consequences for our future. These consequences, as reviewed in the last post, are far more serious than people are aware, and because of academia’s refusal to explore and understand the full destructive effects of inequality, the public, the media, and even the profession itself, are a long way from appreciating this reality. A further problem is that avoiding a Trump presidency, in the current plutocratic socioeconomic situation, is not our only serious concern.

The current political situation is shaped by a sobering set of basic considerations:

- All of politics is grounded in economics. As the saying goes, “it’s the economy, stupid.” Everything people need – from their food, clothing, and shelter to their health care and transportation – costs money, and people know when it is getting harder to make ends meet;

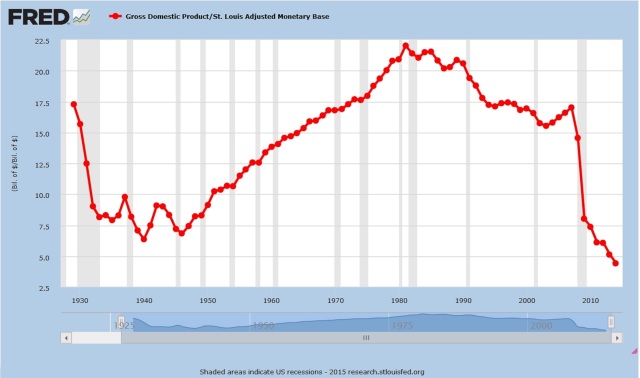

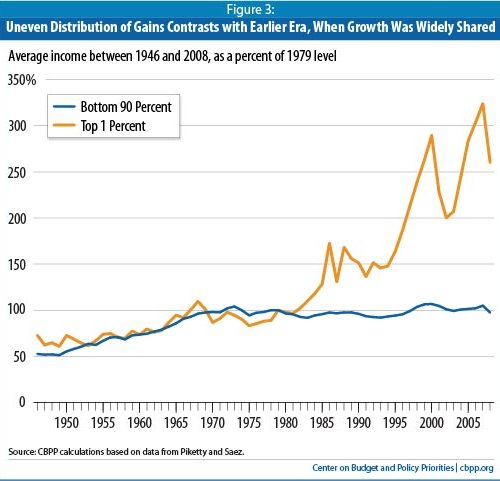

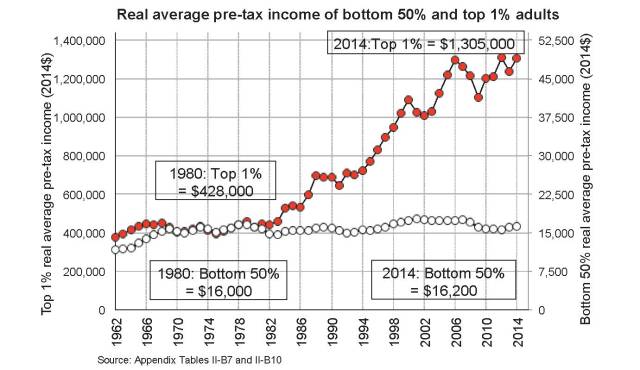

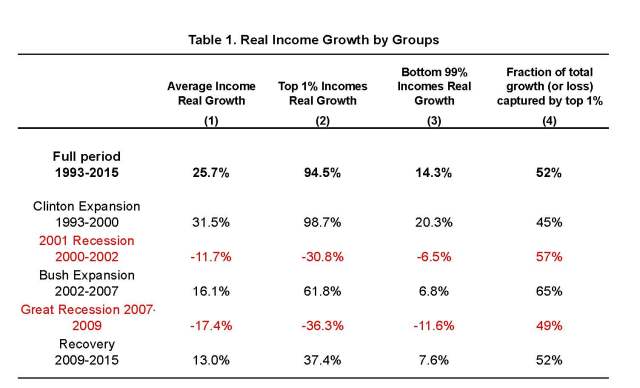

- Inequality growth is a linear process in which money is progressively moved from the lower classes to the top and the economy progressively shrinks overall. This is the underlying factor behind our failing democracy, and our failure to understand that fact renders the American people susceptible to extremely dysfunctional politics;

- Although the declining real incomes of the vast majority of Americans explains the widespread rejection in the primaries of the party establishment and its orthodoxy by both Democrats and Republicans, media political analysis has failed to acknowledge or focus on the primacy of the voters’ economic concerns. The Sanders campaign really was a political revolution, but mainstream media turned its back on that fact;

- The media are controlled by wealthy billionaires, and the news analysis we read, listen to on the radio, or watch on TV is skewed in a way that protects the interests of wealth. The primary interest of wealth thus protected is the desire to avoid taxation;

- We are accustomed to accept “argument by authority,” and the most authoritative voices presented to us on economics, such as that of Nobel laureate Paul Krugman, are presented as objective opinion, but in truth are constrained by and shaped to favor the interests of wealth, leading to positions that are dangerously wrong, and that threaten our survival.

This is the most bizarre presidential campaign season in years and, to the best of my recollection, in my lifetime. As our unacknowledged depression gradually deepens, and people increasingly feel the pain, obviously they would be expected to make their concerns known in the political process. But the revolt against mainstream politics has moved well beyond the Occupy Wall Street demonstrations of 2011, which resulted in 2012, predictably enough, in a political revolt against the reigning Democratic Party. Now both parties find themselves on the political ropes, and the really significant socioeconomic development is that the Republican Party is threatened with a complete collapse. Some of its leaders have refused to back Donald Trump or endorsed Hillary Clinton, but most, at this stage of the game, are falling in line behind him in the interest of party preservation. This post takes a close look at the revolt in each party, with special attention to the inequality economics set forth in the last post, and to the media distortions that shape our views, as revealed by the articles published in The New York Times.

The Republican Meltdown

The last post discussed a recent article by Eduardo Porter of The New York Times which cited a Pew Research Center report indicating that 80 percent of its total polling base, 78 percent of Bernie Sanders’s supporters, and virtually all (98 percent) of Donald Trump’s supporters, “feel either angry or frustrated” with government. We do not have an income profile of these intensely disgruntled Trump supporters, but some 61 percent of Trump’s supporters indicated that their incomes are not “keeping up with the cost of living, and 75 percent of them said they feel that “life for them is worse than it was 50 years ago.”

It would be tempting to conclude that most of the public’s low-income angst would be levelled at the outgoing administration, in the traditional fashion of uninformed voters. There has been some argument to that effect (“Unhappy with the Obama economy, voters are buying what Trump’s selling,” by Jana Kasperkevic, The Guardian, May 7, 2016, here):

Obama has unarguably overseen a remarkable turnaround in the jobs market. The unemployment rate is now half the 10% peak it hit at the height of the recession. * * * But with paychecks remaining disappointingly small and layoffs reaching a seven-year high, many have subscribed to Trump’s narrative instead of the one presented by Obama’s administration. It’s a horror story about an American economy in terminal decline, its workers sold down the river to China and Mexico.

The implicit recognition by The Guardian of persistent decline inherent in Trump’s claim that the American economy is in “terminal decline” is an advanced perspective, something you will not see in The New York Times: But what is unique in “Trump’s narrative” that has prompted this wholesale rejection of party orthodoxy? Of course, for workers in coal mining and other industries subject to layoffs, improved overall employment statistics are not impressive. Regardless, the reactions of laid-off workers in such industries cannot explain what has happened to the Republican Party: Trump not only won the nomination, but crushed all of his opposition in a once-large field that quickly narrowed to a small handful of opponents by the time of the Florida primary. The remaining presidential hopefuls at that point, Ted Cruz, Marco Rubio (both of whom were already unpopular with rank-and-file voters), Jeb Bush and John Kasich never had any momentum with the Republican base.

Blow-by-blow accounts of the Republican primaries are available, but need not be reviewed here. The key point is that the GOP establishment was dismayed by the popularity of a candidate who manifestly lacked presidential stature, and was singularly unprepared and noncommittal on the issues. The GOP pushed back, even trotting out Mitt Romney at one point to condemn Trump’s bid. But none of these efforts worked.

The reason Trump supporters abandoned the party establishment should be fairly obvious: Clearly the GOP had become dominated by the libertarian “Tea Party” faction, so primary voters were not attracted to Trump because they felt the party mainstream was somehow less distrustful of government than they were. No, they rebelled because they felt betrayed by the GOP establishment, which they had served faithfully, helping to foment dissension and discord on socioeconomic and racial issues, only to find that the GOP economic playbook had backfired in their faces. As it became painfully clear in recent years that “stimulating” the economy by choking off and reducing government (austerity) simply has not worked for them, suddenly they had found the candidate of their dreams: Donald Trump reinforced their racism, sexism, and xenophobia while insisting that they could and should have more jobs and higher incomes without having to put up with more dreaded government. He did not tell them how it could be done, just that he could do it, and his magical arrogance and belligerence was enough for them. Believing that nonsense, of course, is supremely stupid and ignorant.

The GOP establishment, naturally enough, finds Trump’s demeanor and independence insufferable. Still, the billionaires that dominate our economy through the GOP do not want to surrender Republican dominance of government. Hence, the beat goes on. Notably, for example, the Regal Entertainment Group, a massive conglomerate of nationwide movie theaters owned by billionaires and multi-millionaires, is right now showing an extremely hate mongering movie entitled “Hillary’s America: The Secret History of the Democratic Party” on an extended run. The movie features the pathologically warped perspective of the controversial right-wing radical Dinesh D’Sousa, a man with no coherent or objective sense of economics or history. The screen is filled with provocative, and occasionally sickening, staged images of lynched slaves and 19th Century warfare. The historical message is that the Democratic Party has always been the embodiment of evil and the defender of slavery, while the Republican Party has always been slavery’s avid foe and the defender of justice. D’Sousa poses as an innocent immigrant searching for the “truth” while he systematically lays out his closed-minded, simplistic ideology.

I had previously seen an earlier D’Sousa movie (2014) entitled “America: Imagine the World Without Her.” There was some Hillary bashing in that movie, but what mainly impressed me about it was the total ignorance it displayed about how the economy works, and its blind faith that America is a land of vast opportunity available to everyone. “Hillary’s America” is considerably darker. Lincoln’s vice president Andrew Johnson, who has come to be regarded as one America’s worst presidents, is singled out for special attention. Johnson opposed the 14th amendment which gave citizenship to former slaves, and he presided over a reconstruction in the South that deprived freed slaves of many civil liberties. D’Sousa presents a scene representing Johnson having sex with a black woman along with scenes depicting KKK riders and other criminals, all said to portray the secret history of the entire, evil Democratic Party. In a snide allusion to Bill Clinton, at one point he quips: “What is it about Democratic presidents and pretty young girls?”

The movie is slanderous in intent and effect. Hillary and Bill Clinton are said to be “depraved crooks,” yet ironically former KKK Grand Wizard David Duke of the modern KKK has enthusiastically endorsed Donald Trump, not Hillary Clinton. The stunning thing to me is that the very wealthy owners of the Regal Entertainment Group would stoop so low as to promote such a trashy, fact-deprived diatribe in their effort to arouse the fears and prejudices of ignorant voters.

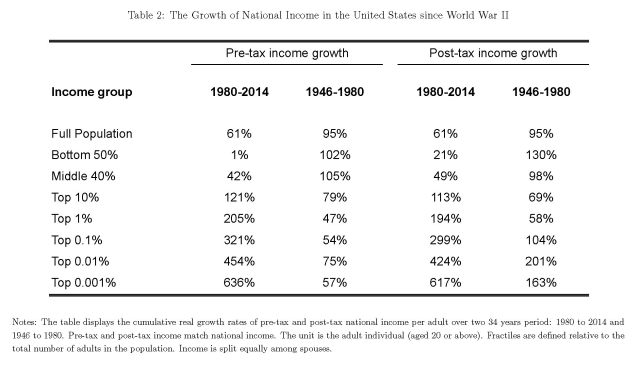

Despite the angst Donald Trump is causing with his disrespectful campaign, there is little new about the underlying con game he is running. The GOP has always played on fears, tribal instincts and bigotry while duping people into voting against their own self-interest by posing as a populist party. Milton Friedman used the lottery as a symbol of the supposed ability of anyone to get rich in America, and Trump uses the same approach. It’s just repackaged in a form that pretends to reject the GOP playbook, while actually endorsing it — with a vengeance. Trump’s taxation plan is draconian, highly favorable to billionaires. He would repeal the estate tax, preserving the leisure class. Until today (“Donald Trump just made a major change to his tax plan,” by Jacob Pramuk, CNBC, August 8, 2016, here), he had planned to reduce the top income tax rate to 25 percent, down from 39.6 percent. That would have been a new low since just before the market crash in 1929 that ushered in the Great Depression. Now Trump proposes a 33 percent top rate. The truth is that any reduction in tax revenue from the wealthiest among us would aggravate the already dangerous inequality problem created by earlier reductions of the top rate, and this of course would gravely harm Trump’s supporters along with everyone else. The top rate would have to be raised to 70% to match its level at the start of the Reagan Revolution.

The New York Times implicitly supports Trump and the GOP in its front page article reporting on these proposal changes (“Trump Outlines Economic Agenda and Tax Changes,” by Neil Irwin and Alan Rappeport, August 9, 2016, here). The article concedes up front that these proposals would provide a “considerable lift” to the wealthiest, and that Trump’s tax policies “track closely with what Republicans in Congress have long advocated.” Because of current exemptions for small estates, the article also points out that “only the very wealthy” benefit from eliminating the so-called “death tax.”

The article next points out that Trump’s plans call for reducing income tax rates for everyone, then computes comparative savings for large and small incomes. Deep in the article (p. A14), when many readers could be expected to push on to other news, the article reveals and briefly criticizes another proposal, for “reducing the corporate income tax rate to 15 percent from its current 35 percent.” Instead of expressing alarm at what would have to be serious revenue impacts of all of these regressive changes, however, the article suddenly added, mid-paragraph, the following:

An analysis by the Tax Foundation found that it would increase after-tax income for middle-income families (those in the 40th to 60th percentile) by 0.2 percent. It would increase after-tax income for the wealthiest 1 percent of Americans by 5.3 percent.

The conservative-leaning foundation found that the plan would reduce revenue by $2.4 trillion over the coming decade using “static analysis,” but that it would result in a comparatively modest revenue reduction of about $200 billion if you assume that lower taxes will result in much stronger economic growth.

Other elements of Mr. Trump’s economic agenda lack details that would make similar analysis possible.

Many reading this deep into the article might not pause to reflect on whether a $2.4 trillion “static” revenue reduction could actually be implemented without resulting in an equally huge off-setting reduction in federal spending, or increase in federal borrowing. The article reports uncritically, and thus implicitly accepts, the entirely false “trickle-down” claim that we can assume that “lower taxes will result in much stronger economic growth.”

That is simply untrue. Only a more progressive tax structure that reduces income inequality can result in economic growth. Any economics reporter (or economist) worth her/his salt should have noticed that after the famous similarly across-the-board (more or less) GW Bush tax cuts, the conservative-leaning (putting it politely) Heritage Foundation Center for Data Analysis conducted a “dynamic simulation” expressing the trickle-down assumption that the Bush tax cuts would result in strong economic growth. The Heritage foundation estimated not merely that that the net revenue reduction would be considerably less than predicted by the “static” computations, but asserted that they would more than pay for themselves in stimulated growth. Its embarrassing prediction was that the national debt would effectively be paid off by FY 2010, i.e., in eight years (“The Economic Impact of President Bush’s Tax Relief Plan, D. Mark Wilson and William Beach, Report #0101, April 27, 2001, here). Exactly the opposite took place: The national debt was not paid off, or even reduced – instead it nearly doubled, from $5.6 trillion at end of FY 2000 to $11.9 at the end of FY 2010 (Treasury Direct, here).

This should be famous among the long record of disproof of the trickle-down fantasy, but New York Times economic reporters continue to report this “right-leaning” garbage with undue deference. In doing so, they implicitly endorse the GOP’s position, and hence greatly enhance Donald Trump’s chances of winning the presidency.

Importantly, to The New York Times, this is political news, and it was reported on the “Elections 2016” page of today’s newspaper. In the “fact Check” column on that page (here), Binyamin Appelbaum purported to disagree with Trump’s seeming assessment that unemployment is much worse than officially reported: “One in five American households do not have a single member in the labor force. Not a single member of the household.” In his response, Appelbaum merely quibbled a bit, but could not fault Trump’s statement. There was, he observed, only 4.9% unemployment in July:

The data, however, is incomplete. The unemployment rate measures the number of people who are actively seeking work. It does not include people who have given up in frustration, who are staying home to care for children or parents, or who have decided to retire.

The evidence suggests a lot of people are still sitting on the sidelines involuntarily.

The problem with Trump on economics is not that the economy is actually doing better than he argues. His problem is that he does not have a clue about, and does not even seem to care about, how the economy grows, or what it takes for the economy to actually offer more jobs: He endorses – in spades – the very GOP economic ideology that created the massive underemployment and declining income problem to begin with.

The Democratic Conundrum

The essence of the Porter article discussed in the last post, and above, was the suggestion that there is a “strong case for more government – not less – as the most promising way to improve the nation’s standard of living.” The Democratic Party is missing its strongest argument: It’s more than just a “strong case.” More government, carefully managed, is essential to growth and improving the standard of living of lower income citizens. Yes,Democrats must better understand inequality and tax progressiveness, but addressing those issues is being steadfastly avoided by the billionaires that own our major mass media sources.

Porter could easily have verified that the incomes of the vast majority of American are not “keeping up with the rising cost of living,” and rejected out of hand the disproved and discredited trickle-down claim that the road to prosperity lies through reduced government spending and taxation. However, he tread lightly, relying on a rehash of public opinion. He linked one of his earlier articles that dealt directly with inequality and taxation, in which he endorsed the conservative propaganda arguing that wealthy capitalists (and their corporations) will avoid increasing their pretax income to avoid higher tax liability.

I have thoroughly reviewed the logical fallacies of the “conservative” lines regarding taxation and progressiveness in my newly-published e-book (Reinventing Economics: The failure of Capitalism and the Economics of Inequality, Amazon Kindle, May 2016), discussing the bogus trickle-down fantasy at some length. Before leaving that topic, I feel compelled to remind readers of Warren Buffett’s point: “People invest to make money, and potential taxes have never scared them off.” (“Stop Coddling the Super-Rich,” Op-ed, The New York Times, August 11, 2011 (here). The trickle-down argument is first cousin of the magical idea that when the rich get richer, everyone else is better off. The mainstream media, however, refuse to expose this “conservative” nonsense.

This kind of thinking, of course, has always favored Republican candidates and now favors Donald Trump. Anyone believing these absurdities will find no economic reason not to vote for Donald Trump. The failure of journalism to counter these arguments, now that the deep flaws in mainstream economics are becoming apparent, effectively takes economic considerations off the political table. Thus, mainstream media functions to ensure that the election will not produce economically rational results.

Just as the RNC rebelled against the Trump candidacy, the members of the DNC, far more privately, marshaled their support for Hillary Clinton during the Democratic Party’s primary season. This is a comparable adverse reaction from the political insiders of both parties to outsider incursions, but that is where the similarity ends: Sanders and Trump supporters, like their leaders, have almost nothing in common ideologically or philosophically. They share only their dismay at their own declining incomes and standard of living: The Sanders supporters, however, are true progressives, much more in tune with the realities of inequality, and much more inclined to see their difficulties in such terms. Crucially, this progressive perspective insists on keeping economic considerations on the table, and on working for elections to produce economically rational results.

The time was ripe for a progressive movement when Sanders entered the race, and disenchanted voters rallied behind him in great numbers.. An Independent running for the Democratic Party’s nomination, Sanders campaigned on behalf of ordinary working people, calling for a “New Deal” revival, hearkening back to the Roosevelt era. The central theme of the Sanders campaign was the need to halt the growth of inequality. He urged restoration of New Deal reforms, including effective collective bargaining, anti-trust enforcement, and the regulation of banks and essential industries, all of which were wiped out by the “Reagan Revolution” which commenced the massive, alarming rise of income inequality. He was especially popular among the “millennials,” younger voters who were several generations removed from the New Deal, and had never experienced symptoms of depression.

There is a commentary thread that says Sanders is less hawkish than Clinton in matters of foreign affairs and national security. Regardless of whether that is true, that clearly was not why he ran for the presidency. The crucial controversies between Sanders and Clinton at the beginning of the primary season were on economic issues, such as the question of bank regulation and breaking up the big banks. In accepting the nomination, Hillary Clinton had to accommodate the incredibly strong support that exists for Bernie Sanders, to endorse a very progressive platform, and to offer to partner with Sanders, Elizabeth Warren, and others to strive for significant change.

Unfortunately, the Democratic platform misses the vitality it would have if the full, dangerous impact of inequality growth was understood by the economics profession, which labors under misconceptions developed over many decades to protect the interests of great wealth, and which have always tended to validate the Republican Party’s agenda. At this point in American history, the inequality issue boils down to a pressing need to tax the rich, but the billionaire-controlled media, and most other wealthy capitalists, continue to avoid the taxation issue, so we are not enlightened on this most important issue.

The Budget Debate

This is unfortunate, for the federal budget and the deficit are currently front page news, covered extensively by The New York Times and other print media. Paul Krugman is the newspaper’s economics Op-ed analyst, and he has also been (and perhaps still is) an advisor to the Clinton campaign: Just before the New Hampshire primaries,Clinton revealed during a debate with Sanders that Krugman had “approved” her economic plan. The cautious gradual approach to reform she advanced at that time does, in fact, reflect Krugman’s perspectives. Although she has since moved to the left in adopting a DNC platform that reflects a much greater sense of urgency, Krugman has not moved with her, as his most recent Op-eds make clear. In last Friday’s Op-ed “No Right Turn,”(August 5, 2016, here), he discussed the swing in the polls in Clinton’s favor, with the result that Trump’s “ugly nonsense gets even uglier and more nonsensical as his electoral prospects sink”:

As a result, we’re finally seeing some prominent Republicans not just refusing to endorse Mr. Trump, but actually declaring their support for Mrs. Clinton. So how should she respond?

Krugman goes on to recommend that Clinton reject advice that she move to the center to try to effect a “grand coalition.” Here is his reasoning:

First of all, let’s be clear about what she’s running on. It’s an unabashedly progressive program, but hardly extreme. We’re talking about higher taxes on high incomes, but nowhere near as high as those taxes were for a generation after World War II; expanded social programs, but nothing close to those of European welfare states; stronger financial regulation and more action on climate change, but aren’t the cases for both overwhelming?

And no, the program doesn’t need to be more “pro-growth.”

There’s absolutely no evidence that tax cuts for the rich and radical deregulation, which is what right-wingers mean when they talk about pro-growth policies, actually work, or that strengthening the social safety net does any harm. Bill Clinton presided over a bigger boom than Ronald Reagan; the Obama years have seen much more private job creation than the Bush era, even before the crash, with job growth actually accelerating after taxes went up and Obamacare went into effect.

It’s true that there are things we could do to boost the U.S. economy. The most important of these things, however, would be to take advantage of very low government borrowing costs to greatly expand public investment — which is something progressives support but conservatives oppose. So enough already with the notion that being on the center-left somehow means being anti-growth.

Let’s break this down: According to Krugman, Clinton does not need “pro-growth” policies. and although Clinton is talking about higher taxes on high incomes, her proposals are modest. He ignores the consistent trend since 1980 of gradually declining growth. But what would a pro-growth policy, in his view, look like? He says there is “no evidence” that tax cuts for the rich “actually work,” but that position is far too equivocal in the face of overwhelming evidence, as discussed above, that tax cuts at the top actually reduce growth and increase inequality. Krugman’s neoclassical perspective misses that, and also misses its corollary — the pro-growth effect of increasing top taxes. Because in his mind taxation offers no prospect for a “pro-growth” policy, Krugman, like Eduardo Porter, has conceded the taxation issue to Trump and the Republicans.

For several years, Krugman has argued that to boost the economy without raising taxes at the top, the government should simply increase its borrowing. But with this argument he has jumped from the frying pan into the fire, putting himself in the awkward position of taking on the growing criticism of our ever increasing national debt. Not surprisingly, the following Monday Krugman turned to the deficit topic (“Time to Borrow,” August 8, 2016, here):

“So what should she do,” he began, “to boost America’s economy, which is doing better than most of the world but is still falling far short of where it should be?” The most important thing America needs, he wrote, is “sharply increased public investment in everything from energy to transportation to wastewater treatment.” This is certainly one of our top priorities, and any such program could help grow the economy. But Krugman continues:

How should we pay for this investment? We shouldn’t — not now, or any time soon. Right now there is an overwhelming case for more government borrowing.

Any time soon? For this incredible proposition, Krugman offers some outrageously dubious arguments:

- The fact that we need more investment, he says, suggests that we should borrow to pay for it, because “this investment might well pay for itself even in purely fiscal terms. How so? Spending more now would mean a bigger economy later, which would mean more tax revenue.” But this is extremely shallow thinking, especially for a Nobel laureate, and it is reminiscent of the conservative (and corollary) argument that tax cuts for the rich might somehow pay for themselves, which they never have. Think about it: There is nothing about a new road or a new bridge that creates more economic activity; and how is it that all the government borrowing over the last 30 years that resulted in $19 trillion of debt has failed to “pay for itself,” or even produce a semblance of growth? Paul Krugman, who has conceded that the “dirty little secret” of the economics profession is that it does not understand growth, simply does not know;

- Public investment, he says, has a potential role in job creation. That is certainly true, and that is the hope of the progressive program. But no sane private employer would keep going into debt, with no additional income source, to keep paying for such jobs. An endless stream of borrowing is not, and cannot, be the answer to any investment program, public or private;

- Krugman notes the objection that “we can’t borrow because we already have too much debt.” Our debt already exceeds $19 trillion, critics “intone in their best Dr. Evil voice.” But belittling the point doesn’t make it go away. Everything about the U.S. economy is huge, he says, and the crucial concern is the comparison between “the cost of servicing the debt and our ability to pay.” And “federal interest payments are only 1.3 percent of GDP, low by historical standards.” This does not, however, offer a valid reason to be sanguine about the rapidly increasing carrying charges on the debt: (1) First, CBO projections show the net interest payments growing from about 1.4% of GDP in 2015 to 3.4% by 2024, because the debt has been consistently growing faster than GDP (“The Budget and Economic Outlook: 2014 to 2024,” CBO, August 2014, here, p. 50); (2) The more pertinent comparison is with other government costs. CBO projections for 2024 are that net interest will exceed the entire projected defense budget by more than $100 billion, and would be 64% the size of the entire discretionary budget, putting an obviously severe strain on the system; (3) Krugman’s argument fails to take into account the excessive burden of the rapidly growing carrying charges, under the current regressive tax structure, on low-income taxpayers, or the fact that the interest payments to wealthy holders of federal debt causes income inequality to grow.

Krugman concludes that “while the politics remains uncertain, it’s clear what we should be doing. It’s time for the federal government to borrow and invest.” But nowhere in this article did Krugman even hint at the best argument for not borrowing more: There would be no need to borrow if we tax the rich instead. Increasing the progressiveness of the tax structure by raising the top rate makes the economy more likely to grow, sustaining new jobs with a continuing source of revenues that are redistributed down from the top into a more active, higher velocity role in the marketplace. But that obvious solution is off the table, and must be ignored by people writing for The New York Times.

More on the Overriding Deficit Issue

Today, Maine’s Republican Senator Susan Collins explained in a PBS News interview why she could not endorse Donald Trump, and when asked she said she could not, unlike some of her Republican colleagues, support Hillary Clinton instead, she explained that Clinton’s progressive agenda was too expensive, and we already have too much federal debt.

The New York Times, meanwhile, continues doggedly to support a reckless “conservative” mythology on the debt issue. Two days before publishing Porter’s article, The New York Times published “However Vote Goes, Expect Rise in Deficits,” by Nelson D. Schwartz (8/1/16, here). The article began with this:

For most voters, the idea of more government borrowing and spending is about as popular as the Zika virus. And while Hillary Clinton and Donald Trump agree on almost nothing, mainstream Democrats and Republicans alike often talk about the national debt the way prohibitionists once discussed booze.

But among economists, the outlook is changing. And with interest rates near historical lows and growth stuck in a rut even as the recovery from the Great Recession moves into its eighth year this summer, even some veterans of Washington’s budget wars are challenging the reigning fiscal orthodoxy that perceives the perennial budget gap as something inherently sinful.

“The views of economists about the deficit are shifting,” said Douglas W. Elmendorf, director of the Congressional Budget Office from 2009 to 2015 and now dean of the Kennedy School at Harvard. “If the very low level of interest rates persists for years to come, as many experts and analysts think is likely, that’s a sea change for budget policy.”

More borrowing might actually be healthy, many economists say, at least in the short term, by helping to elevate the economy’s long-depressed growth trajectory.

Here, Schwartz poses as someone who is providing an objective cross-section of all economic opinions. In reality, he decides whose views to report and what conflicting opinions to emphasize. This is not the objective reporting it appears to be: Quoting Douglas Elmendorf to the effect that the continuation of low interest rates might somehow enable more borrowing to “elevate the economy’s long-depressed growth trajectory,” is like quoting Paul Krugman to the effect that more borrowing could perhaps even “pay for itself.”

To be sure, Elmendorf’s arguments have not been as radical as Krugman’s. Before he left his post as director of the CBO, Elmendorf had presided over equivocal findings that continuous budget deficits cannot be sustained “indefinitely,” an obvious point, really, with the carrying charges on the debt already threateningly high and continuing to grow exponentially. But Elmendorf is still on the wrong side of this issue. Like Krugman, he expresses no sense of urgency about a problem that is already becoming alarming.

A serious problem with his thinking is that CBO does not recognize any macroeconomic effect of inequality growth. Thus, as wealth and incomes continue to concentrate at the top exponentially, effectively sequestering the incomes and wealth of other Americans as the debt rises, CBO’s deficit projections are perpetually over-optimistic, ignoring the demonstrated effect of growing inequality in suppressing overall growth. So, even under current policies (the CBO “base case”), the CBO has underestimated the danger in the current situation.

Like Eduardo Porter and Paul Krugman, Nelson D. Schwartz rumbles through his entire long analysis with no hint that the answer might lie in significantly higher taxes at the top of the income ladder. Without even acknowledging the existence of that option, he concludes that “regardless of who wins in November, it now appears that the next president is more likely than not to end up backing, if not embracing, more deficit spending.” Some experts, Schwartz casually reports, “fear that Mr. Trump will push the government to max out on debt, as many Trump properties have done over the years.”

He does emphasize that Trump’s proposals to radically cut income taxes would greatly change the outlook:

But the Committee for a Responsible Federal Budget, a bipartisan group that advocates fiscal restraint, estimates that Mr. Trump’s plan to cut taxes could raise the national debt by $11.5 trillion over the next decade to roughly $35 trillion in 2026.

Hillary Clinton, while also likely to preside over a rise in federal borrowing, is far more restrained. But her proposals could quickly add up.

In its 2014 Budget Outlook, which was the last one to present enough detail for this kind of review, CBO projected debt held by the public to rise by roughly $7 trillion between 2015 and 2024. Thus, the CRFB projection appears to have estimated that the Trump tax reduction proposals would roughly double the amount of new debt to be expected under current taxation. Clearly, the total federal debt would increase substantially, and the already dangerous level of debt coverage would be well over the top.

Why not avoid all this drama and risk by substantially raising taxes at the top? Schwartz’s discussion of increased taxation is quite limited:

According to Mrs. Clinton’s plan, adjusting the business tax code would “fully pay for these investments.” Yet a broad overhaul of corporate taxation has been talked about by both Democrats and Republicans in Washington for years with little to show for it.

Well, that’s politics. And right now, although Trump is gleefully talking about huge reductions in the top income tax rate, there are no citations in any of these New York Times articles to anyone even considering an increase in the top income tax rate. That too is politics, and it is becoming ever clearer who controls the conversation.

Summary and Conclusions

In this post I have focused mostly on The New York Times coverage of politics and the economic issues that are now gaining the most attention. As it looks increasingly likely that Clinton can hold off a determined challenge by an egregiously unqualified candidate that has earned the enmity of much of his own party, it would be really bizarre for that newspaper to end up not supporting Hillary Clinton for president.

A careful review of its articles and op-eds, however, shows that the New York Times economic reports, including the opinions of Paul Krugman himself, are at worst endorsing the Republican trickle-down fantasy or, at best, failing to forcefully reject it. Very wealthy people are unwilling to entertain proposals to raise their taxes, and the issue of tax progressiveness, always obfuscated, is now entirely off the table. The Republicans would simply (and some of them gleefully) trash our economy and our country, but the Democratic Party is also infected with the trickle-down disease, despite Clinton’s proposal to impose on the wealthy their “fair share” of taxation.

The bottom line is that our country is firmly plutocratic, with the politics of both political parties dominated by the interests of extreme wealth. Because, as discussed in the prior post, the economics of inequality remains poorly understood by nearly everyone, the reality of how badly this political reality is harming our once vibrant economy, and at least partially functional democracy, is almost completely obscured. The overwhelming importance of taxing the rich has gone unnoticed by the mainstream, billionaire-owned media, and by all of the presidential candidates, with the exception of Bernie Sanders. Plutocracy in America is not yet all-powerful, but it is powerful enough to keep us largely in the dark about the extremely harmful effects of income and wealth concentration.

My expectation is that the overall level of awareness of inequality issues will not change much in the near future. It is frightening to see very wealthy people promote the hateful prejudices of people like Dinesh D’Sousa, choosing to help rip our social fabric apart, and to ignore all of the problems of the real world that require good will and cooperation to solve, rather than suffer the slightest diminution of their wealth.

At least their agenda is clarified: But because inequality is a far more serious problem than generally imagined, the political process has become far more precarious than we realize. It seems likely that Hillary Clinton will win in November. However, even in a Hillary Clinton first term there is a real chance of another stock market crash that will swallow up perhaps 25 percent or more of America’s financial wealth, with great damage to the underclasses, eclipsing the liberal agenda she has staked out.

The scariest thing about politics is our ignorance about economics: Such a crash will come as a major surprise. Things may have to get much, much worse before they can get better. That is a prospect, quite frankly, that we should all find terrifying. Still we must continue to hope for the best, and work for a better world.

JMH – 8/10/16

Harrison, J. Michael DELMAR J. Michael Harrison passed away at home on May 20, 2017. He was born in Nebraska and grew up in South Dakota. He graduated from Oberlin College in 1966 and the University of Michigan Law School in 1970. He served as an administrative law judge for New York State for the majority of his career and retired in December, 2005. His empathy, humor and generosity made a lasting impression in many lives. He was a talented musician, lover of arts, and a passionate advocate for environmental, socio-economic and animal rights and preservation. He also loved spending time with his adoring family. J. Michael lives through his wife, Betty Harrison; his son, J. Ryan Harrison; his daughter, Xoxenia Harris; his sister, Judith Harrison; his stepdaughter, Sharon Christenson; and his grandchildren, Detrevien, Robert, Sean and Leah. He was predeceased by his brother, David Harrison; and stepson, Richard Harrison. Calling from 5-7 p.m. on Thursday at Meyers Funeral Home, 741 Delaware Ave Delmar. Services will be held at St. Stephen’s Episcopal Church in Delmar on Friday at 11 a.m. In lieu of flowers, the family requests a donation be considered to either Defenders of Wildlife, Earth Justice, or the

Harrison, J. Michael DELMAR J. Michael Harrison passed away at home on May 20, 2017. He was born in Nebraska and grew up in South Dakota. He graduated from Oberlin College in 1966 and the University of Michigan Law School in 1970. He served as an administrative law judge for New York State for the majority of his career and retired in December, 2005. His empathy, humor and generosity made a lasting impression in many lives. He was a talented musician, lover of arts, and a passionate advocate for environmental, socio-economic and animal rights and preservation. He also loved spending time with his adoring family. J. Michael lives through his wife, Betty Harrison; his son, J. Ryan Harrison; his daughter, Xoxenia Harris; his sister, Judith Harrison; his stepdaughter, Sharon Christenson; and his grandchildren, Detrevien, Robert, Sean and Leah. He was predeceased by his brother, David Harrison; and stepson, Richard Harrison. Calling from 5-7 p.m. on Thursday at Meyers Funeral Home, 741 Delaware Ave Delmar. Services will be held at St. Stephen’s Episcopal Church in Delmar on Friday at 11 a.m. In lieu of flowers, the family requests a donation be considered to either Defenders of Wildlife, Earth Justice, or the